The Preferred Choice.

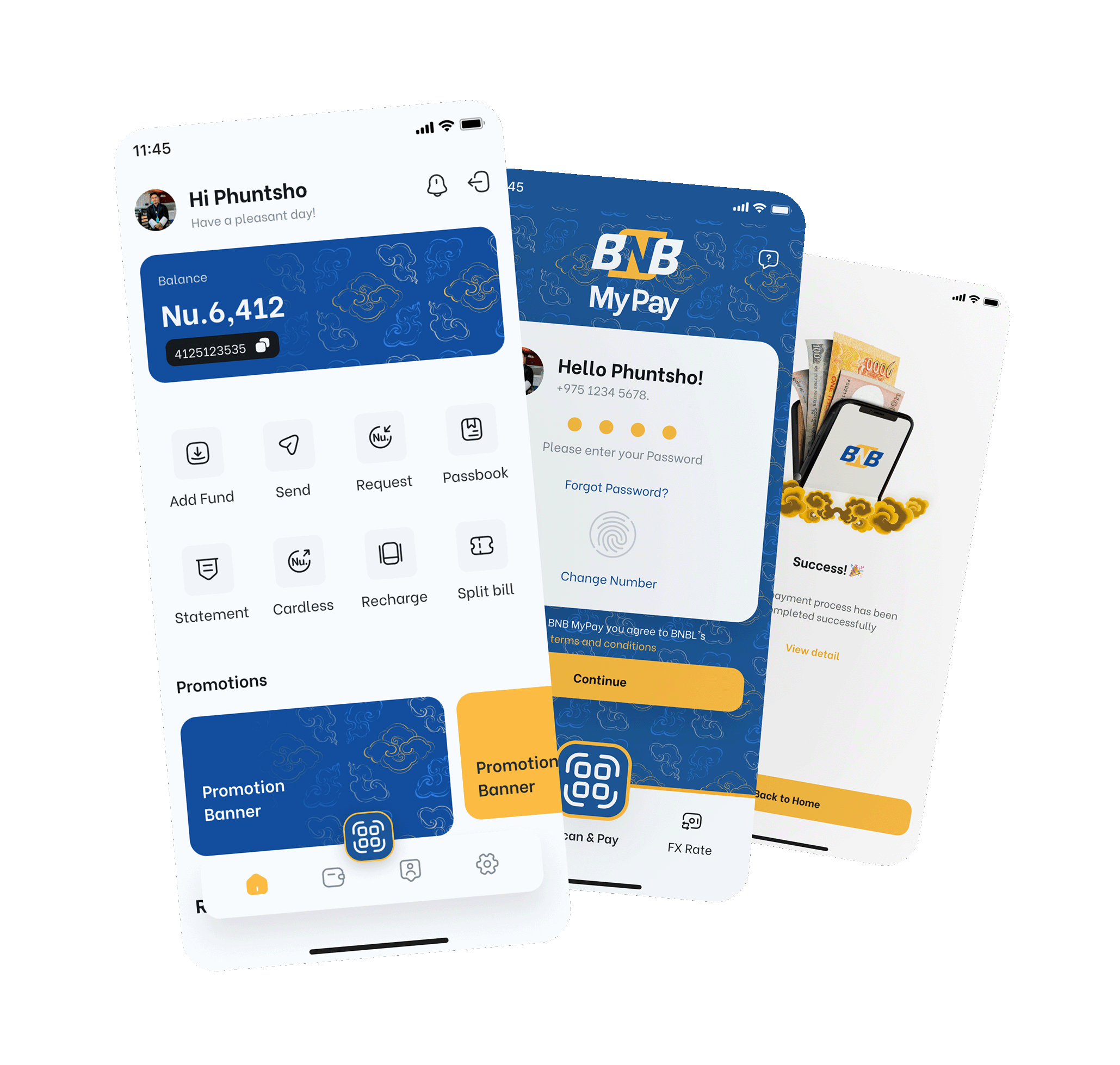

BNB MyPay is a mobile wallet app which is equivalent to a physical wallet where we can store digital versions of cash, credit and debit cards, loyalty cards, coupons etc. Using this stored value account, we can transfer/receive money, make merchant and utility bill payments.

One of the main objectives of MyPay is to give financial services to the unbanked population, thereby enabling broader financial inclusion. The other important objective is to provide a safe, secure and easy tool for the incoming tourists to make local payments conveniently.

forms and documents.

Features

Add Fund

This feature is used to add fund to your wallet. Fund can be added through your cards and your bank account.

Passbook

This feature displays the income and expenses associated with your wallet.

Recharge

This feature is used to recharge any B-Mobile and TCell mobile numbers.

Request

This feature is used for requesting money for other wallet users.

Send

This feature is used for sending money to other wallet users or to any BNBL account.

Split Bill

This feature is used to split the bill among your friends or family.

Statement

This feature is used for viewing your wallet statement.

QR Code

This feature is used for making payment using QR codes.

Help Center

This feature helps wallet user to contact bank regarding issues they face.

Change Registered Mobile Number

Customers can change to new mobile number if required.

Download Statement

Statement can be downloaded to the device.

Removal of 2% Convenience Fee

No charges on fund transfer to Bank Account via Send Money (only BNB accounts available right now) and Scan & Pay (to all bank accounts)

Interactive Passbook

With Income and Expense segregated.

Add Email

Email can be added during registration process.

Bill Payment

Tashi Cell

Postpaid and Leased Line payments

Bhutan Telecom

Postpaid, Broadband, Fixed Line and Leased Line payments

Samuh

Subscription and VCinema payments.

Upcoming Features

Add Fund From MPay

The feature will allow wallet user to load their wallet from BNB MPay.

MyPay is the digital equivalent of a physical wallet where we can store digital versions of cash, credit and debit cards, loyalty cards, coupons etc. Using this stored value account, we can perform the following services:

- Cash-In via BNB Account and Cards

- Cash out via BNB Account

- P2P Transfer (Wallet to Wallet, Wallet to BNB Account)

- Recharge BT and TCell Numbers

- Request and Send Money

- Cardless ATM Withdrawal

- Refer & Earn

- Check transaction history

- Pay Merchants (QR Code Payment)

- Utility Bill Payments

Anyone with a valid Bhutan Telecom and Tashi Cell mobile number can register to MyPay wallet.

You can download the MyPay Wallet application from authorized stores like Play Store & App Store and register with your BT or TCell Mobile number.

or

You can also visit any convenient BNB branch or extension office for registration.

You can add money to MyPay from BNB account or any international credit/debit card.

| Customer Categories | Daily Transaction Limit | Daily Balance Limit | Aggregated Monthly Limit |

|---|---|---|---|

| Basic User (Resident & not submitted CID copy and limit enhancement form) | 2,000 | 5,000 | 10,000 |

| Verified User(Resident & submitted CID copy and Limit Enhancement Form) | 30,000 | 50,000 | 100,000 |

| Premium User(Tourist) | 100,000 | 200,000 | 500,000 |

You can submit a duly filled limit enhance form along with a CID copy to the nearest BNB branch/extension office or submit it through email to contact@bnb.bt

You will require a valid BT or TCell mobile number and MyPay application.

No, MyPay wallet can be used locally within Bhutan only.

Yes, MyPay wallet is safe and secure to use with security measures like, biometric (finger print & facial recognition) or MPIN login, TPIN to authorize the transactions. However, it is always better to be cautious and not share your user credential with anyone.

No, we don’t require a bank account to register to MyPay wallet.

You can download the MyPay wallet application from authorized stores like Play Store and App Store.

After logging in, there is a feature to change TPIN and MPIN in the settings.

- Always keep the user credentials strong, unique and safe.

- Keep your device secure and up to date with the latest security updates

- Only download the app from authorized Play Store and App store

Registration is free and there are no other charges except for adding money via cards to the wallet and cashing out from wallet to bank account. Minimal service fee of 2% will be charged while transferring cash from wallet to bank account and payment processor fee of 4.5% will charged while loading cash via card.